nassau county tax rate calculator

NASSAU COUNTY ASSESSMENT REVIEW COMMISSION. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

New York Income Tax Calculator Smartasset

Nassau County NY Sales Tax Rate The current total local sales tax rate in Nassau County NY is 8625.

. Our Nassau County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Assessment Challenge Forms Instructions. In dollar terms Westchester.

The New York sales tax rate is currently 4. The State of Delaware transfer tax rate is 250. 74 rows Nassau County New York Sales Tax Rate 2022 Up to 8875 Nassau County Has No.

STIPULATION OF SETTLEMENT CALCULATOR. Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages. Texas has a 625 sales tax and Harris County collects an additional NA so the minimum sales tax rate in Harris.

The lowest effective tax rate in the state was 393 per 1000 levied on homes and businesses in the Sagaponack school district portion of the Suffolk County town of Southampton. The average cumulative sales tax rate in Nassau County New York is 865 with a range that spans from 863 to 888. Delaware DE Transfer Tax.

The December 2020 total local sales tax rate was also 8625. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county. You can find more tax rates and.

This includes the rates on the state county city and special. Nassau County Sales Tax Rates for 2022 Nassau County in New York has a tax rate of 863 for 2022 this includes the New York Sales Tax Rate of 4 and Local Sales Tax Rates in Nassau. Nassau County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Nassau County totaling 1.

This is the total of state county and city sales tax rates. Nassau County Florida Property Tax Go To Different County 157200 Avg. 074 of home value Yearly median tax in Nassau County The median property tax in Nassau County Florida.

The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. The minimum combined 2022 sales tax rate for Nassau New York is 8. Tax Collector Office Locations Locations in Yulee Callahan Hilliard and Fernandina Beach.

How to Challenge Your Assessment. Nassau County FL Property Appraiser. Nassau county tax rate calculator Sunday March 6 2022 Edit.

Where Do Homeowners Stay In Their Homes The Longest The New York Times

:max_bytes(150000):strip_icc()/new-york-city-taxes-141a08d29b504e2fb8bf658eb5777c35.png)

An Overview Of Taxes In New York City

Sales Tax Calculator And Rate Lookup Tool Avalara

Property Tax By County Property Tax Calculator Rethority

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

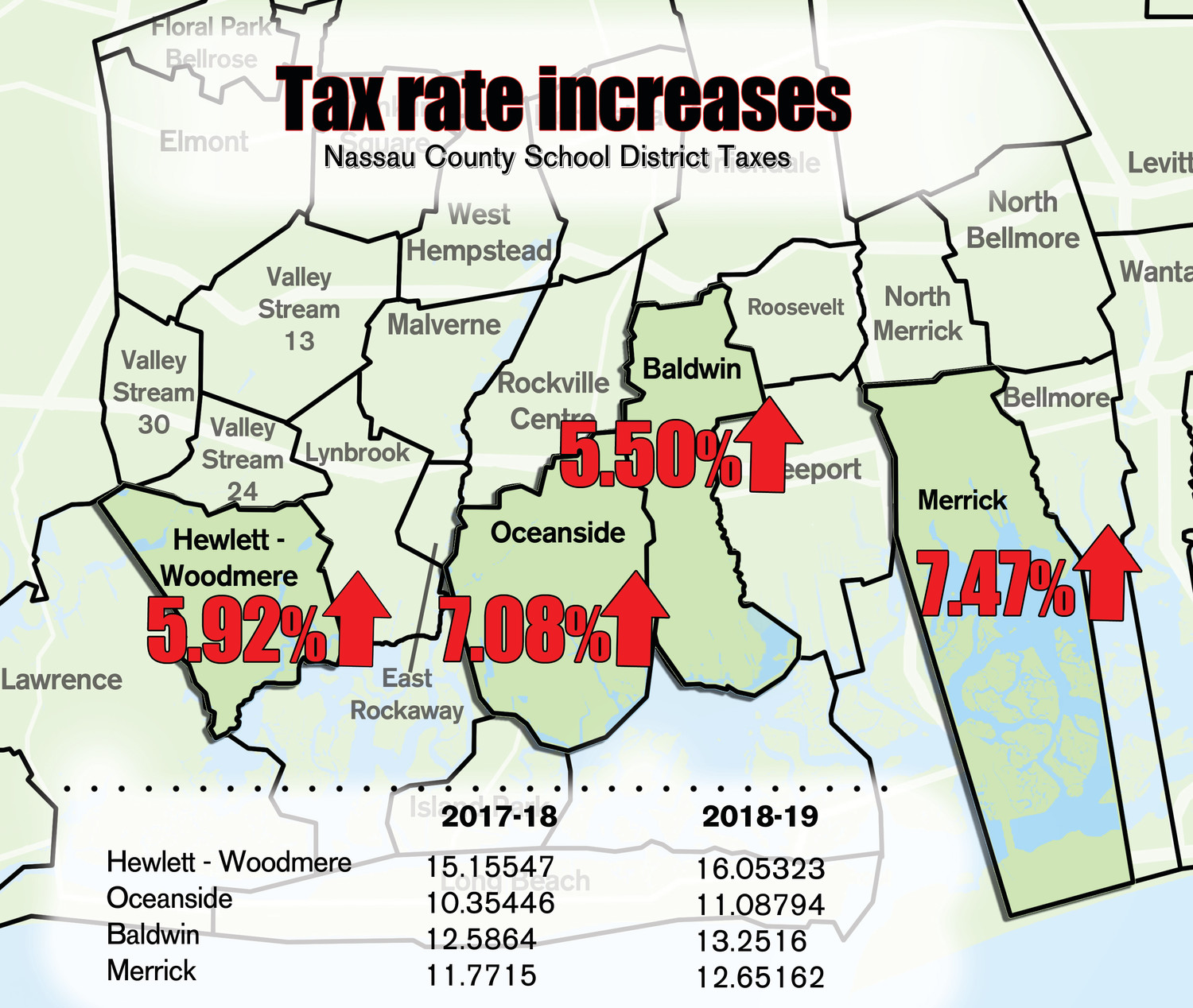

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Interest Only Mortgage Calculator Hauseit Nyc

Otsego County Ny Property Tax Search And Records Propertyshark

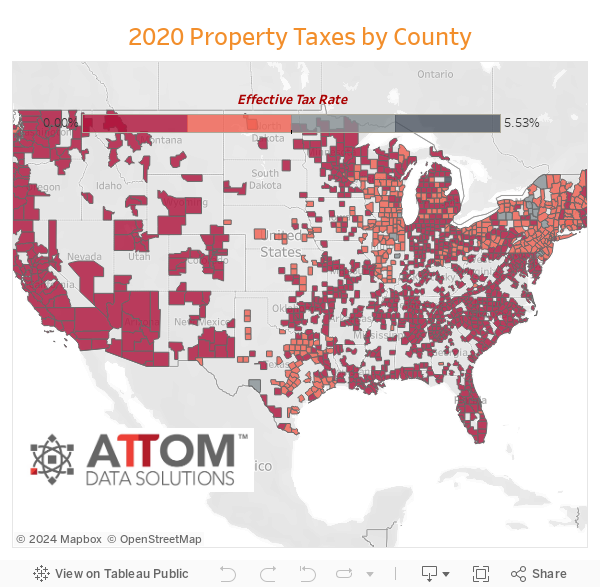

New York Property Taxes By County 2022

The Tax Levy Limit When Is 2 Not Really 2

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

How To Calculate Sales Tax For Your Online Store

New York Property Tax Calculator Smartasset

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Nassau County Proposed Budget 2021 Unveiled Mineola Ny Patch

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Retirement Distribution Calculator Capital Financial